What is BloombergGPT?

BloombergGPT is an impressive feat of Artificial Intelligence (AI) developed by Bloomberg. This large-scale generative AI model was purpose-built with 50 billion parameters, specifically to address natural language processing (NLP) tasks in the financial industry. How does it work? BloombergGPT employs a unique approach combining financial data with general-purpose datasets to train a model that excels in financial tasks, without sacrificing performance in general NLP benchmarks. The model uses a decoder-only causal language model based on a 363 billion token dataset consisting of English financial documents, augmented with a 345 billion token public dataset.

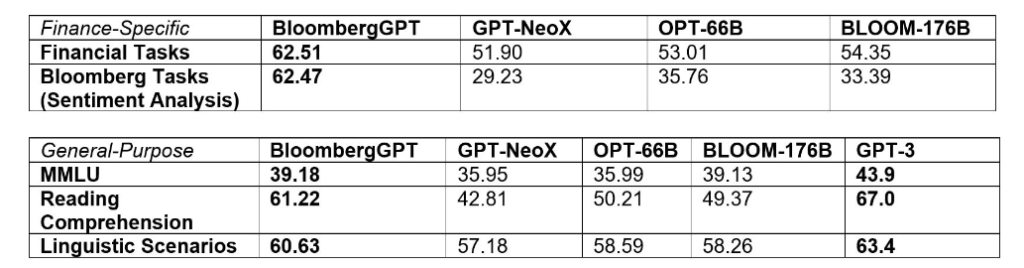

How does BloombergGPT outperform similarly-sized open models on financial NLP tasks?

The impressive results from BloombergGPT are due to its specific training on a vast range of financial data. The model blends financial data with general-purpose datasets, resulting in enhanced performance in financial tasks, while maintaining performance on general NLP benchmarks. BloombergGPT has many uses in the financial industry. It can assist in improving existing financial NLP tasks like sentiment analysis, named entity recognition, news classification, and question answering. It can also be used to automate financial reporting, process complex financial documents, and assist with in-depth financial research.

Despite its specialization in finance, BloombergGPT maintains competitive performance on general NLP benchmarks. This suggests that it can potentially be used for tasks in other domains that require advanced language understanding and generation. The model was developed by Bloomberg’s Machine Learning Product and Research group, in collaboration with the firm’s AI Engineering team, using Bloomberg’s four-decade-long experience in curating financial documents to create a powerful domain-specific training dataset.

What are the uses of BloombergGPT in the financial industry?

The benefits of using BloombergGPT are vast. It can analyze and extract insights from a vast amount of financial data, including market trends, company reports, and economic indicators. BloombergGPT automates the generation of financial reports, processes complex financial documents, and conducts sentiment analysis of financial news. Additionally, it enables Bloomberg to handle vast amounts of data available on the Bloomberg Terminal, better serving its clients.

Can BloombergGPT be used in non-financial industries?

Yes, BloombergGPT, developed by Bloomberg, is primarily designed for the financial industry, but it can also be used in non-financial industries. As a language model, BloombergGPT can understand and generate human-like text across a wide range of topics. While it may have been trained on financial data and have a strong understanding of financial terminology, it can still provide valuable information and generate text on various subjects beyond finance.

For non-financial industries, BloombergGPT can assist with tasks such as natural language processing, text generation, content creation, customer support, data analysis, research, and more. Its ability to comprehend context, generate coherent responses, and provide relevant information can be utilized in many domains like healthcare, technology, education, marketing, and entertainment.

However, it’s worth noting that there are other general-purpose language models available, such as OpenAI’s GPT-3, that have been trained on a broader range of data and can be more suitable for non-financial applications. The specific use case and requirements should be considered when selecting the most appropriate language model for a particular industry or application.

Who created BloombergGPT?

The Machine Learning Product and Research group at Bloomberg, in conjunction with the AI Engineering team, collaborated to create BloombergGPT. Leveraging Bloomberg’s extensive four-decade expertise in curating financial documents, they constructed a training dataset tailored to the financial domain, facilitating the development of the domain-specific model.

The specific cost associated with using BloombergGPT is not mentioned in the available information. For more detailed and accurate information regarding pricing and usage, it is recommended to reach out to Bloomberg directly or request a demo from their official channels. They will be able to provide the most up-to-date and comprehensive details regarding the cost and availability of BloombergGPT.

Is BloombergGPT free to use?

The specific cost associated with using BloombergGPT is not mentioned in the available information. For more detailed and accurate information regarding pricing and usage, it is recommended to reach out to Bloomberg directly or request a demo from their official channels. They will be able to provide the most up-to-date and comprehensive details regarding the cost and availability of BloombergGPT.

Can BloombergGPT assist in financial research?

Absolutely, BloombergGPT can be a valuable tool for researchers and analysts in the finance industry. It empowers them to delve into comprehensive financial research, delve into intricate financial concepts, and generate insightful analyses. By leveraging the capabilities of BloombergGPT, finance professionals can gain a deeper understanding of the market, make informed decisions, and extract valuable insights from financial data.

How is BloombergGPT different from other AI models?

BloombergGPT stands out from other AI models in the market due to its unparalleled expertise in financial tasks and its massive architecture that boasts a staggering 50 billion parameters. This cutting-edge model has been tailor-made to comprehend and create text based on financial language and data, which ultimately enables it to outpace other open models of similar size when tackling financial tasks. Provided by Bloomberg, a renowned name in the financial industry, BloombergGPT is a sophisticated and advanced tool that has been built to meet the high demands of the financial sector. Its unparalleled ability to analyze and generate financial language and data is a game-changer, making it a valuable asset for any financial institution.